Blockchain applied to lending

A reality in the United States. A future in Europe?

At the end of September 2021, the cumulative capital invested in the top 25 fintechs dealing with cryptocurrencies (which represent one of the main applications of blockchain) amounted to USD 7 billion and included mostly companies of North American origin, but also Indian, Australian, Mexican, or European companies [source: CB Insights’ ranking of the top 250 global fintechs in terms of funding].

Definition: Blockchain can be defined as a data structure that enables the creation of a digital book of data (time-stamped and permanently registered) and its sharing within a network of individuals in an open (public blockchain), partially controlled (authorized or consortium blockchain), or closed (private blockchain) circle. This technology has applications in virtually all economic sectors, such as logistics (e.g., tracking) or construction (e.g., site management, construction compliance). It also gives rise to new forms of assets such as cryptocurrencies and, more broadly, NFTs, which are unique and tamper-proof electronic records to which the market assigns a value (an image, for example).

Blockchain likes to present itself as a disruptive technology, especially in finance and financial services: Crypto-asset promoters profess to compete with central currencies, while proponents of decentralized finance (DeFi) advocate the disintermediation of the traditional financial sector. The ultra-fast development of the Coinbase platform illustrates the scope of this technology to build a complete financial system ex nihilo: This fintech has created from scratch an exchange with an order book to trade the main crypto assets, a brokerage company that makes this market accessible to individuals, and an electronic wallet to host crypto assets, as well as high-volume storage solutions for institutions (custody) and a payment system in crypto assets for merchants. Accessible only to U.S. residents, these platforms have a growing success with millions of subscribers; this is the case with Robinhood, one of Coinbase's competitors.

The blockchain world cultivates a certain amount of mystery about its intentions and achievements. Even if many projects are met with skepticism, it is impossible to ignore this rapidly developing phenomenon's technologies and uses.

We propose here an overview with a particular focus on the uses of credit. Emerging players could strongly disrupt this field in the short- or medium-term.

Fintechs dealing with financing via blockchain emphasize the fluidity of the processes they manage, the time and efficiency gains, and the costs. They advocate "the end of costly and superfluous third parties, time-consuming processes and skyrocketing costs" [source: Introduction of an article by Sam Daley on the site builtin.com].

What are "classic" lending products processed in the blockchain? These are mainly mortgage loans, but also personal loans, or consumer credit.

Blockchain technology offers an unprecedented opportunity to alleviate the public's growing frustration and distrust of dysfunctional centralized financial systems. By distributing data across a network of computers, this technology allows any group of individuals to opt for transparency rather than control by a central entity" says the Maker Platform white paper.

There are two very different approaches to lending underpinning the projects.

The school of decentralized finance (Defi)

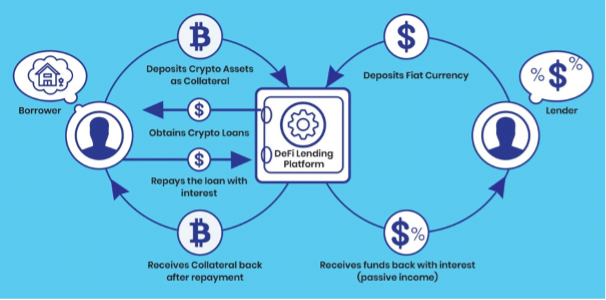

This approach is based on large-scale peer-to-peer financing principles. Blockchain technology comes into play at two levels.:

A peer-to-peer lender is a loan from one individual to another without a financial institution intermediary.

- It allows to set up and manage contracts automatically (smart contracts)

- It secures the loan via a crypto asset the borrower carries as collateral for the loan. This device considerably limits the information collected from the borrower (no need to know their income or credit score). In the United States, these loans do not require KYC neither AML procedures.

- The value of the collateral represents only a portion of the value of the crypto asset. This "discount" applied to the crypto asset allows the lender to have a margin of safety from possible changes in the crypto asset over the life of the loan.

- The loan made is refinanced by the crypto asset savings of an anonymous third party who has deposited their asset units in an electronic safe.

- The decentralized logic of the blockchain intervenes with the definition of the "consensus" necessary to set the contract's rules of operation. (The voters are the anonymous founders of the blockchain protocol.) Once the algorithm has validated the transaction, it is recorded in the blockchain (like a time-stamped entry in an accounting ledger) and becomes definitive and inviolable. Collection operations are automatically managed within the framework of the smart contract.

Explanatory diagram of a loan with guarantee

Source: crowdfunding-platforms.com

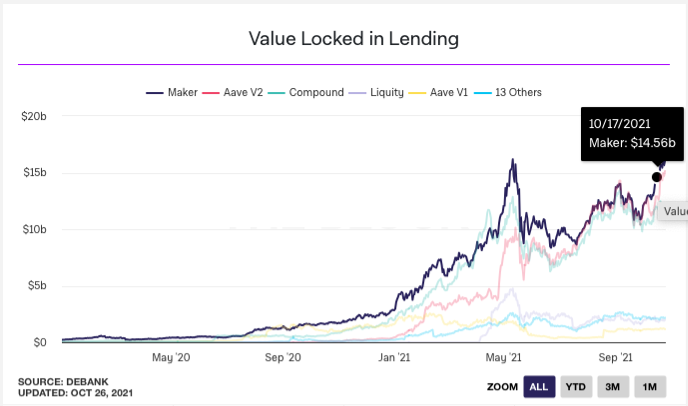

The amount of gross value committed to decentralized finance today is around USD 100 billion. The value of secured loans represents about half of this outstanding amount. This market remains marginal in the US context but is growing rapidly.

Four main players share the market: Aaave [V1 and V2] , Maker , Compound, and Liquity

Source: theblockcrypto.com

Maker's case is particularly interesting; this project, born in 2014 based on "democratic" governance and open-source developments, has given birth to Dai (also known as Multi Collateral Dai), a stable crypto asset backed by the US dollar. Maker relies on the Ethereum 2 blockchain (issuer of the crypto asset Ether, Bitcoin's competitor), like most decentralized finance projects. From a practical point of view, the borrower deposits Dai in a vault which gives him access to a loan. His vault is then unlocked upon repayment of the loan, and he pays a stability fee; all transactions are done using Dai. The operation must always respect a minimum value of the liquidation ratio (this ratio relates the value of the collateral to the value of the loan granted). If this ratio falls below the reference value, the community can net the operation by auctioning off the collateral. As of mid-October 2021, the value of loans issued under the Maker Protocol reached $15 billion.

One of the usages of the loans issued by these systems is to buy crypto assets on credit, betting on a capital gain when resold. In this spirit, unsecured loans (flash loans) are now available, with the particularity of being immediately repayable (i.e., they only serve to promote the transaction of instantly purchasing crypto assets).

Secured loans in crypto assets are also the business of centralized platforms. They, too, are based on Ethereum2, falling within the logic of decentralized finance but on a less "pure" model since they act as intermediary between the saver and lender. The latter cannot maintain anonymity and thus, must submit to KYC and AML procedures. Examples in this category are Blockfi, Celsius, Nexo or Youholder.

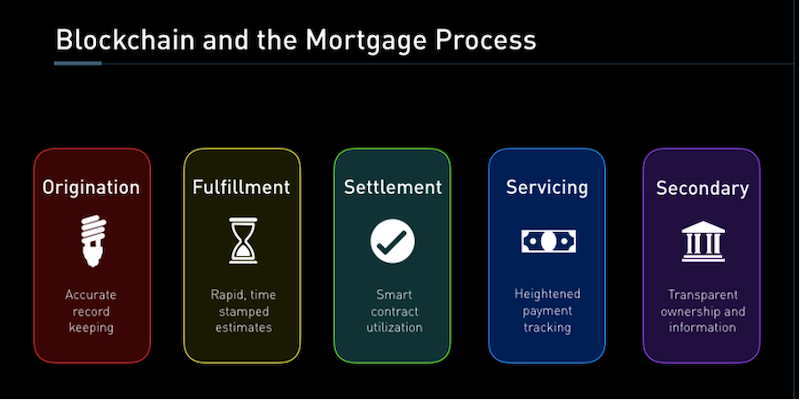

Production blockchain school

While claiming the benefits of a blockchain (efficiency, speed, security, and elimination of intermediaries), other platform types fit more readily into the existing financial system. These platforms operate on a peer-to-peer basis and use partner funds, offer regulated financing products for individuals and companies, and manage securitization operations involving banking partners.

One of them, Figure, offers a particularly successful model.

Founded in 2018 in San Francisco, Figure has raised $1.6 billion since its inception, including $200 million in May 2021, and is valued today at $3.2 billion. Originally, Figure's founders wanted to develop a blockchain to compete with Ethereum. Instead, they launched the Provenance blockchain, a public and decentralized blockchain accessible in open source. To demonstrate the operationality of their new tool, they have developed an application with Figure.

This platform now offers the three functionalities of blockchain:

- Asset transfer: Figure Pay allows instant payments

- Asset tracking: Figure Wallet provides access to digital and non-digital assets and allows you to build a portfolio

- Automatic contract execution: Figure offers a full range of financing products, including mortgage, equity loan, consumer credit, and securitization. The platform claims to save 117 basis points on the cost of a securitization transaction compared to a traditional process.

Source: plugandplaytechcenter.com

Moving into a new phase of its development, Figure has acquired Homebridge Financial Services to benefit from its goodwill (150,000 customers, $20 billion in loan production per year), and gain access to banking approvals and test the implementation of its solutions in a traditional environment.

This fintech is, therefore, at an advanced stage of development, and its strategy is clear: Insert blockchain into traditional financial circuits.

What about projects in Europe?

As is often the case, innovations born on the other side of the Atlantic take a certain amount of time (increasingly shorter) to reach the European market.

If the first logic described above is linked to the context of the United States (and not without risk), the second (production blockchain) could be adapted to the European market:

- Either by importing an existing model to conquer new markets (on the model of payment fintechs or neo-banks)

- Or by developing applications specific to the European market

However, this hypothesis raises several questions:

- What would be the trigger? The emergence of a demand? The will of the legislator or the European supervisor?

- What would be the reception of the European public to this partially decentralized finance (contrary to our financial culture)? Will the interest of such an evolution be perceived? How can it be shared?

- What would be a realistic scope for experimentation, and what level of gains (costs and delays) should be expected?

- What would be the consequences on existing financing models and particularly the universal banking model? To what extent does blockchain call into question the need for middle- and back-office teams?

These are all questions that lead us to observe what is happening across the Atlantic, launch POCs on the subject, survey clients on their spontaneous reactions, and brainstorm on the strategic issues that arise from the blockchain.

Rémi Legrand

Monge Conseil

https://www.mongeconseil.fr

Vincent Geneste

Alto Forte Consulting

https://altoforte.consulting