Where does Fintech stand in mid-2021?

Fintech was not immune to the disruption caused by the health crisis, but it quickly regained strong momentum.

A troubled global context but favorable factors

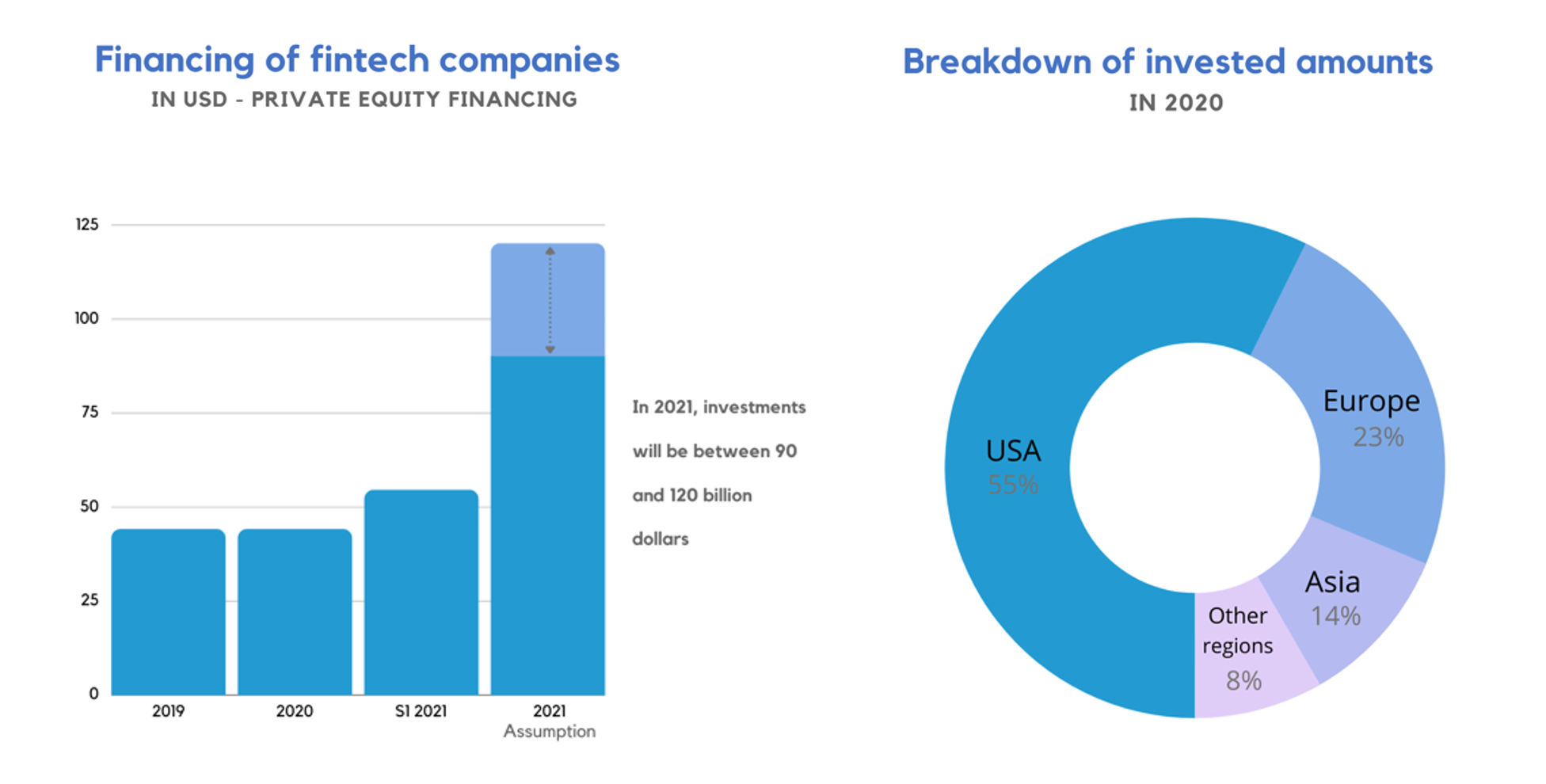

Although Fintech companies are natively flexible in their organizations and innovative in the ways they work, they nevertheless suffered a slowdown in their development in 2020. This was reflected in the stabilization of investments between 2019 and 2020 (USD 44 billion globally – Amount of private equity investments in Fintechs – source: CB-Insights). However, this situation followed an inflection of the amounts invested between 2018 and 2019 (minus 8%). One wondered at the end of 2019 if investors were starting to doubt the growth dynamics of Fintechs.

In addition to the constraints related to the health crisis, the last 18 months have been characterized by:

- The persistence of abundant liquidity on the market and therefore of investors looking for innovative projects;

- An increase in cybercrime attacks leading to increasingly heavy consequences; the fight against this scourge is becoming a priority for both public authorities and companies, and expectations are high in terms of technical countermeasures to these attacks;

- The development of the use of private crypto-assets in exchanges and the confirmation of institutional crypto-currency projects.

Fintechs – A strong dynamic

The result of these market conditions is a substantial acceleration of projects resulting in massive investments in the first half of 2021. Private equity financing reached USD 54.4 billion in the first six months of the year, already 23% more than in the full year 2020. These investments are heavily concentrated on mature projects, with deals over USD 100 million accounting for 70% of the amounts invested.

North America, particularly Silicon Valley and New York, represents the major development zone for Fintechs with 55% of the investments recorded. Investments in Fintech represent one-third of the USD 150 billion injected into North American start-ups in the first half of 2021 (Source: Pitchbook; quoted in 'Les Echos,' August 12, 2021). However, Europe (including the UK) holds a prominent place with 23% of investments and is ahead of Asia (14%). Investments in French Fintechs represent €1.5 billion (Source of the figures for Europe: Sifted), and they are behind Sweden (1.6) and Germany (2.1). The Fintech sector is the most financed tech sector in Europe, and the region has no less than 30 unicorns. These companies are particularly attractive to the US and Chinese investors. In addition, South America has shown strong momentum, with a 150% growth in investments between the first and second quarters of 2021 (USD 2.5 billion in the second quarter).

What are the most promising technologies and usages?

Developments that rely on the blockchain are experiencing a jump: They are funded to the level of USD 7.2 billion in the first quarter of 2021 (more than 400 funding transactions), a growth of 157% compared to the full year 2020. In addition, blockchain applications are diversifying and specializing.

These include the following:

- Business-to-business payments (Circle, which has raised USD 440 million)

- Materialization of cryptocurrency assets through crypto chips (Ledger, 380 million)

- Development tools for blockchain infrastructures (Black.one for 300 million)

- Loans secured by cryptocurrency assets (BlockFi for 350 million)

- Applications analyzing the blockchain to detect anomalies and fraud on crypto-asset transactions (Chainanalysis is valued at 2 billion USD)

Payment apps are thriving:

- They are developing in Latin America, which represents a strong potential (Ebanx, a Brazilian company that offers cross-border payments in the region, has raised USD 430 million, Clip in Mexico, USD 350 million)

- Anti-fraud solutions are multiplying and reaching critical size (Forter and Signifyd have raised USD 300 million and USD 205 million, respectively)

- Several start-ups offer virtual corporate card and expense management solutions.

Deferred payment (Pay Now Buy Later or PNBL) is becoming widespread through generalist technical solutions (Jifiti offers white label financing solutions in plug and play mode) and niche products (Maroo allows newlyweds to spread the cost of their wedding); salary advance systems are successful in developing countries like India and Indonesia.

Other usages are reflected in projects that are already mature around the following:

- Access for the general public to non-traditional asset types;.

- Management of bank accounts for specific segments (divorced parents, unbanked foreign workers, etc.)

What do these Fintechs deliver at the 'moment of truth'?

Initial public offerings have multiplied in recent months (Development of SPAC – Special Purpose Acquisition Company – vehicles to foster these operations). They are a moment of truth where the company's value is directly subjected to the law of the market. These operations have had varying fortunes:

- The American company Flywire, which went public in May 2021, has maintained a share price above its objectives since its IPO (around USD 30 for a starting target of USD 24 per share);

- The consumer-broker Robinhood, introduced at the end of July, remains slightly below its IPO price (USD 35 for a target of USD 38) and is experiencing strong variations (see the analysis of this IPO in Les Echos dated July 29, 2021); doubts are being expressed about the sustainability of this company's model based on large volumes with low profitability; it is worth noting that the traditional broker Charles Schwab, which has 15 times fewer clients than Robinhood, is valued at more than four times more than the startup (USD 125 billion for less than 30 billion);

- Crypto-currency trading platform Coinbase is back to near its IPO value (i.e., USD 240 for a company valuation of USD 65 billion) after a good price surge at launch (up to USD 340).

Summary of key figures

Sources: CB-Insight, Sifted, out of 2021 estimate

Sources: CB-Insight, Sifted, out of 2021 estimate

What are the consequences for the major European financial services groups?

After 18 months of the health crisis, Fintech appears to be a key element of the future of financial services more than ever. Moreover, the amounts invested by private equity and the valuations reflected in IPOs indicate a strong potential for these highly technological and innovative solutions. Blockchain in particular seems to have reached a milestone in the diversification of its uses and the size of the Fintechs it generates.

While risk is not absent from Fintech projects, the average size of these projects is increasing, and they are starting to seriously compete with more traditional financial groups. The latter are keeping strong profitability for themselves, and they therefore have the choice between several strategic orientations:

- Position yourself as a buyer in the market and focus on promising Fintechs to integrate their technology and customer approach. This option requires a perfect knowledge of the market to select the right targets and set the right price;

- Multiply partnerships with Fintechs to expand offerings and meet customer expectations. This approach limits risks and investments but implies sharing the value created with partner Fintechs;

- Invest massively in-house in the mastery of technologies and the transformation of business models. Such an orientation makes it possible to master the entire value chain but requires great agility in internal changes (skills, technologies, production and distribution models, etc.).

As the figures above show, Europe is gradually becoming an important area of activity for Fintech and is now a favorable ecosystem for innovation for large financial services groups. Silicon Valley and New York, however, remain the nerve centers of innovation from which the major trends and many of the key players of tomorrow are emerging.

Rémi Legrand

Monge Conseil

https://www.mongeconseil.fr

Vincent Geneste

Alto Forte Consulting

https://altoforte.consulting